Stock Packaging

We supply businesses with a wide selection of essential packaging, shipping, and warehouse supplies. Get any standard packaging product by dimension or style from boxes, tubes, tapes, labels, and more. If you are unsure on what type of packaging you will need, then contact us for an expert consultation.

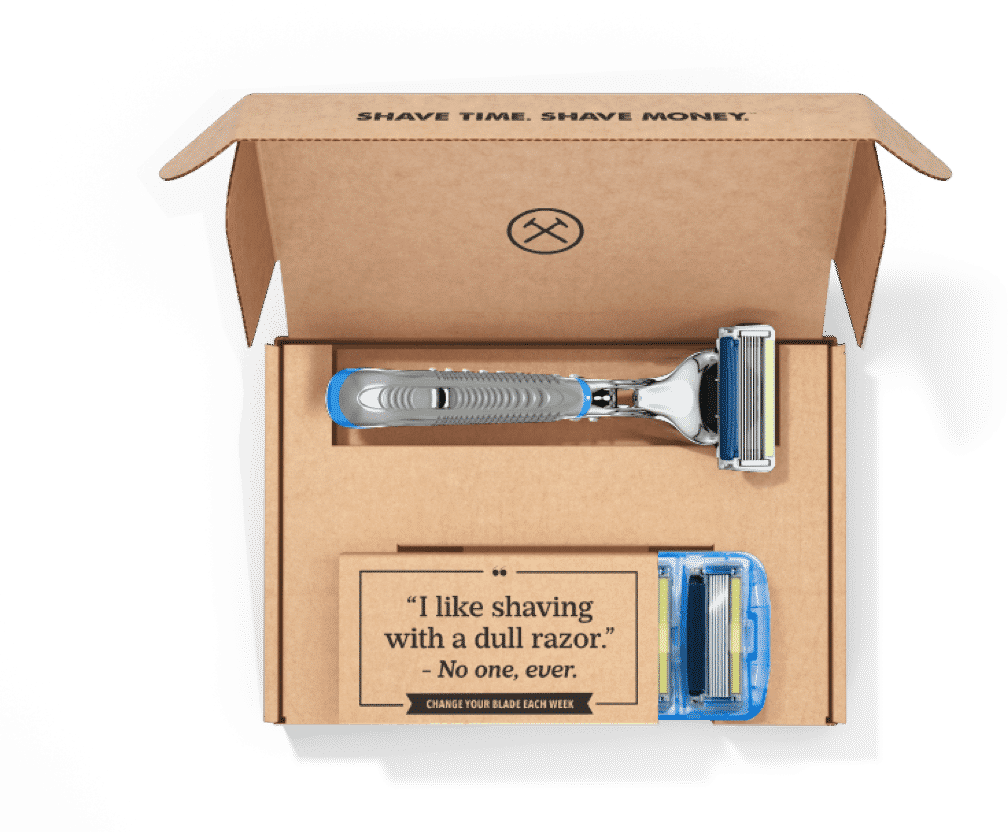

Stock packaging refers to pre-made, ready-to-ship packaging solutions like corrugated boxes, mailers, and protective materials that are designed to meet a wide range of standard needs across shipping, retail, and storage. Unlike custom packaging, stock options offer quick availability and reliable protection without the need for extensive design or production time, making them ideal for businesses needing efficient, high-quality solutions with fast lead times.

At Brown Packaging, we focus on providing durable, performance-driven stock packaging that supports our clients’ operational needs. Our stock products are sourced to ensure consistent quality and cost-effectiveness, offering a practical solution to keep operations running smoothly and on schedule. With an emphasis on reliability, we help our clients quickly access packaging solutions that meet their specific needs while maintaining quality across every order.

Our stock packaging products, from corrugated boxes to stretch film, offer a wide selection, including essentials like tape, edge protectors, labels, and more, with quick turnaround times to meet your packaging needs efficiently.

If you need any assistance with your packaging or have a question, then contact us directly at request@brownpackaging.com or (714)300-0650. Learn more about custom packaging by reading our blog posts on new and trending topics.