Sustainable Packaging

Explore our sustainable packaging products, including corrugated boxes, folding cartons, pouches, and stock packaging options. We offer eco-friendly materials and a variety of print and ink choices to fit your packaging needs. Choose from solutions designed to support sustainability and meet your business requirements.

Sustainable packaging refers to the use of materials and design methods that minimize environmental impact. This can include using recyclable or biodegradable materials, reducing excess packaging, and opting for renewable resources like paper, kraft, or corrugated materials. The goal is to reduce waste, conserve energy, and lessen the overall carbon footprint of packaging.

By choosing sustainable packaging, businesses help limit the negative effects of packaging waste on the environment. These products are often recyclable, compostable, or reusable, making them a more eco-friendly option. Sustainable packaging balances the need for protection and branding with the responsibility to preserve resources for future generations.

Our sustainable packaging products include custom corrugated boxes, folding cartons, pouches, and a variety of stock options. Each product is designed with eco-friendly materials to help reduce environmental impact while meeting your packaging needs.

Corrugated Boxes

- Regular slotted Container (RSC)

- Half Slotted Container (HSC)

- Full Overlap (FOL)

- Roll End Tuck Top (RETT/Mailer)

- Additional Box Styles

- Corrugated Inserts

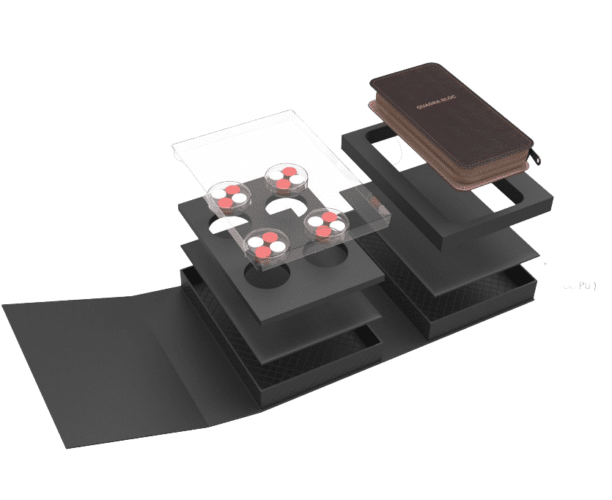

Folding Cartons

- Straight Tuck End (STE)

- Reverse Tuck End (RTE)

- Full Seal

- Auto Bottom

- Chipboard Inserts

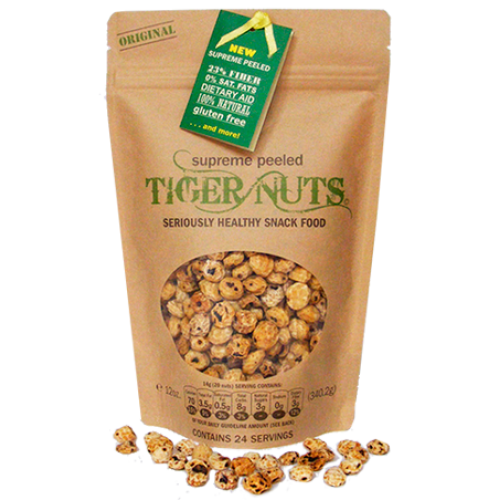

Pouches

- Stand Up

- Lay Flat

- Gusseted

- Retort

- Block Bottom

- Sachets

- Additional Pouch Styles

Stock Packaging Products

- Corrugated Packaging

- Shipping Boxes

- Chipboard Packaging

- Edge Protectors

- Mailers (Kraft)

- Kraft Tape

- Kraft Paper

At Brown Packaging, we prioritize eco-friendly packaging solutions that help reduce environmental impact. Our commitment to green packaging ensures that we provide sustainable materials, allowing you to make responsible choices for your business and the planet.

Today, many consumers are increasingly seeking sustainable products over cheaper alternatives that are less environmentally friendly. According to a global study by Nielsen, millennials, in particular, are willing to pay more for sustainable options, but they aren’t willing to compromise on quality in the process.

At Brown Packaging, we are committed to delivering innovative, eco-friendly packaging solutions that create a better future without sacrificing quality. Whether you need stock or custom packaging, we help reduce your environmental footprint with materials that are recyclable, biodegradable, or compostable. Our focus is on balancing sustainability with the performance and durability your business requires.

- Fully Customizable

- Wide Product Selection

- Recyclable

- Biodegradable

- Compostable

- Environment Friendly Print Options and more

Today, many consumers are increasingly seeking sustainable products over cheaper alternatives that are less environmentally friendly. According to a global study by Nielsen, millennials, in particular, are willing to pay more for sustainable options, but they aren’t willing to compromise on quality in the process.

At Brown Packaging, we are committed to delivering innovative, eco-friendly packaging solutions that create a better future without sacrificing quality. Whether you need stock or custom packaging, we help reduce your environmental footprint with materials that are recyclable, biodegradable, or compostable. Our focus is on balancing sustainability with the performance and durability your business requires.

- Fully Customizable

- Wide Product Selection

- Recyclable

- Biodegradable

- Compostable

- Environment Friendly Print Options and more

Today, many consumers are increasingly seeking sustainable products over cheaper alternatives that are less environmentally friendly. According to a global study by Nielsen, millennials, in particular, are willing to pay more for sustainable options, but they aren’t willing to compromise on quality in the process.

At Brown Packaging, we are committed to delivering innovative, eco-friendly packaging solutions that create a better future without sacrificing quality. Whether you need stock or custom packaging, we help reduce your environmental footprint with materials that are recyclable, biodegradable, or compostable. Our focus is on balancing sustainability with the performance and durability your business requires.

- Fully Customizable

- Wide Product Selection

- Recyclable

- Biodegradable

- Compostable

- Environment Friendly Print Options and more

Recyclable, Biodegradable, and Compostable Packaging

When it comes to sustainability, recycling is often the most commonly discussed concept by consumers, the media, and businesses alike. However, many companies are increasingly exploring biodegradable and compostable packaging as viable alternatives to traditional recycling methods.

Recyclable packaging is designed to be processed and reused after its initial use, reducing the need for new raw materials and minimizing waste. It can be collected through recycling programs and converted into new products, helping to conserve resources and lower environmental impact. Common examples of recyclable packaging include materials like cardboard, paper, certain plastics, and metals, which can be easily sorted and reintroduced into the manufacturing cycle.

Biodegradable packaging is made from materials that naturally break down over time through the action of microorganisms, such as bacteria or fungi, without leaving harmful residues. This type of packaging is designed to decompose in the environment, helping to reduce waste in landfills and minimize pollution. Typically made from natural or plant-based materials like paper, cornstarch, or bioplastics, biodegradable packaging offers an eco-friendly alternative to traditional packaging by returning to nature without damaging the ecosystem.

Compostable packaging is designed to break down into natural elements under specific composting conditions, leaving no toxic residue behind. It typically decomposes more quickly than biodegradable packaging and must meet certain standards to ensure it fully returns to the earth as nutrient-rich compost. Made from materials like plant-based fibers or biodegradable plastics, compostable packaging provides an eco-friendly option that contributes to healthier soil when processed in commercial or home composting environments.

As sustainability becomes a top priority for businesses and consumers alike, compostable and biodegradable packaging are now essential components of eco-friendly practices. With increasing regulations and growing consumer demand for environmentally responsible products, companies must adapt to greener packaging solutions to remain competitive and compliant. The shift toward sustainable packaging is no longer optional—it’s a necessity for businesses aiming to meet modern expectations.

At Brown Packaging, we specialize in providing tailored packaging solutions that not only meet industry standards but also promote environmental responsibility. From retail compliance to government regulations, we work closely with clients to create packaging that balances performance, sustainability, and innovation, ensuring your brand stays ahead in a rapidly evolving marketplace.

Recyclable, Biodegradable, and Compostable Packaging

When it comes to sustainability, recycling is often the most commonly discussed concept by consumers, the media, and businesses alike. However, many companies are increasingly exploring biodegradable and compostable packaging as viable alternatives to traditional recycling methods.

Recyclable packaging is designed to be processed and reused after its initial use, reducing the need for new raw materials and minimizing waste. It can be collected through recycling programs and converted into new products, helping to conserve resources and lower environmental impact. Common examples of recyclable packaging include materials like cardboard, paper, certain plastics, and metals, which can be easily sorted and reintroduced into the manufacturing cycle.

Biodegradable packaging is made from materials that naturally break down over time through the action of microorganisms, such as bacteria or fungi, without leaving harmful residues. This type of packaging is designed to decompose in the environment, helping to reduce waste in landfills and minimize pollution. Typically made from natural or plant-based materials like paper, cornstarch, or bioplastics, biodegradable packaging offers an eco-friendly alternative to traditional packaging by returning to nature without damaging the ecosystem.

Compostable packaging is designed to break down into natural elements under specific composting conditions, leaving no toxic residue behind. It typically decomposes more quickly than biodegradable packaging and must meet certain standards to ensure it fully returns to the earth as nutrient-rich compost. Made from materials like plant-based fibers or biodegradable plastics, compostable packaging provides an eco-friendly option that contributes to healthier soil when processed in commercial or home composting environments.

As sustainability becomes a top priority for businesses and consumers alike, compostable and biodegradable packaging are now essential components of eco-friendly practices. With increasing regulations and growing consumer demand for environmentally responsible products, companies must adapt to greener packaging solutions to remain competitive and compliant. The shift toward sustainable packaging is no longer optional—it’s a necessity for businesses aiming to meet modern expectations.

At Brown Packaging, we specialize in providing tailored packaging solutions that not only meet industry standards but also promote environmental responsibility. From retail compliance to government regulations, we work closely with clients to create packaging that balances performance, sustainability, and innovation, ensuring your brand stays ahead in a rapidly evolving marketplace.

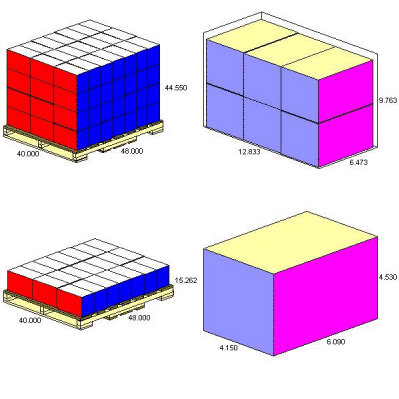

We provide packaging solutions designed to help reduce your carbon footprint through eco-friendly production, efficient shipping, and sustainable materials. From pallet optimization to energy-efficient manufacturing, our approach ensures that your packaging minimizes environmental impact at every stage.

Our custom structural design services allow us to minimize material use without compromising protection. By optimizing the design for strength and efficiency, we help you reduce excess packaging and the environmental costs associated with waste. Smarter packaging design means a lower carbon footprint overall.

With CAPE software, we optimize pallet configurations to maximize space and load efficiency. This results in fewer trips and lower fuel usage during transportation, reducing your carbon footprint. By making the most of every pallet, we help you achieve more eco-friendly logistics.

We offer digital samples, eliminating the need for multiple physical prototypes, which reduces waste and energy use in production. By creating virtual models, we help you save resources while speeding up the design process. This eco-friendly approach helps minimize the carbon footprint of packaging development.

We focus on eco-friendly production processes that minimize waste and reduce energy consumption. By using sustainable materials and optimizing manufacturing efficiency, we help lower the carbon footprint of your packaging. This commitment to sustainable production ensures a smaller environmental impact from the start.

Our lightweight and efficient packaging solutions help reduce transportation emissions by maximizing space and minimizing weight. By designing packaging that is easy to transport, we help your business cut down on fuel consumption and overall shipping costs, contributing to a reduced carbon footprint.

We design packaging with durability and reusability in mind, extending the useful life of each product. By creating packaging that can be used multiple times before disposal or recycling, we help reduce waste and conserve resources, contributing to a smaller environmental footprint.

We prioritize sourcing materials from local suppliers to reduce transportation distances and emissions. By keeping production and distribution close to home, we help cut down on the environmental impact associated with long-distance shipping. Local sourcing ensures a more sustainable and efficient supply chain.

We offer packaging made from eco-friendly, recyclable, and biodegradable materials that reduce reliance on virgin resources. By using sustainable materials, we help decrease the carbon emissions associated with material extraction and production. This ensures that your packaging has a smaller environmental impact from the very start.

Interested In Sustainable Packaging Solutions?

Discover the latest insights on sustainable packaging by exploring our blog, where we share tips and innovations to help businesses reduce their environmental impact. Stay informed about eco-friendly packaging solutions and learn how your company can make a difference through sustainability.

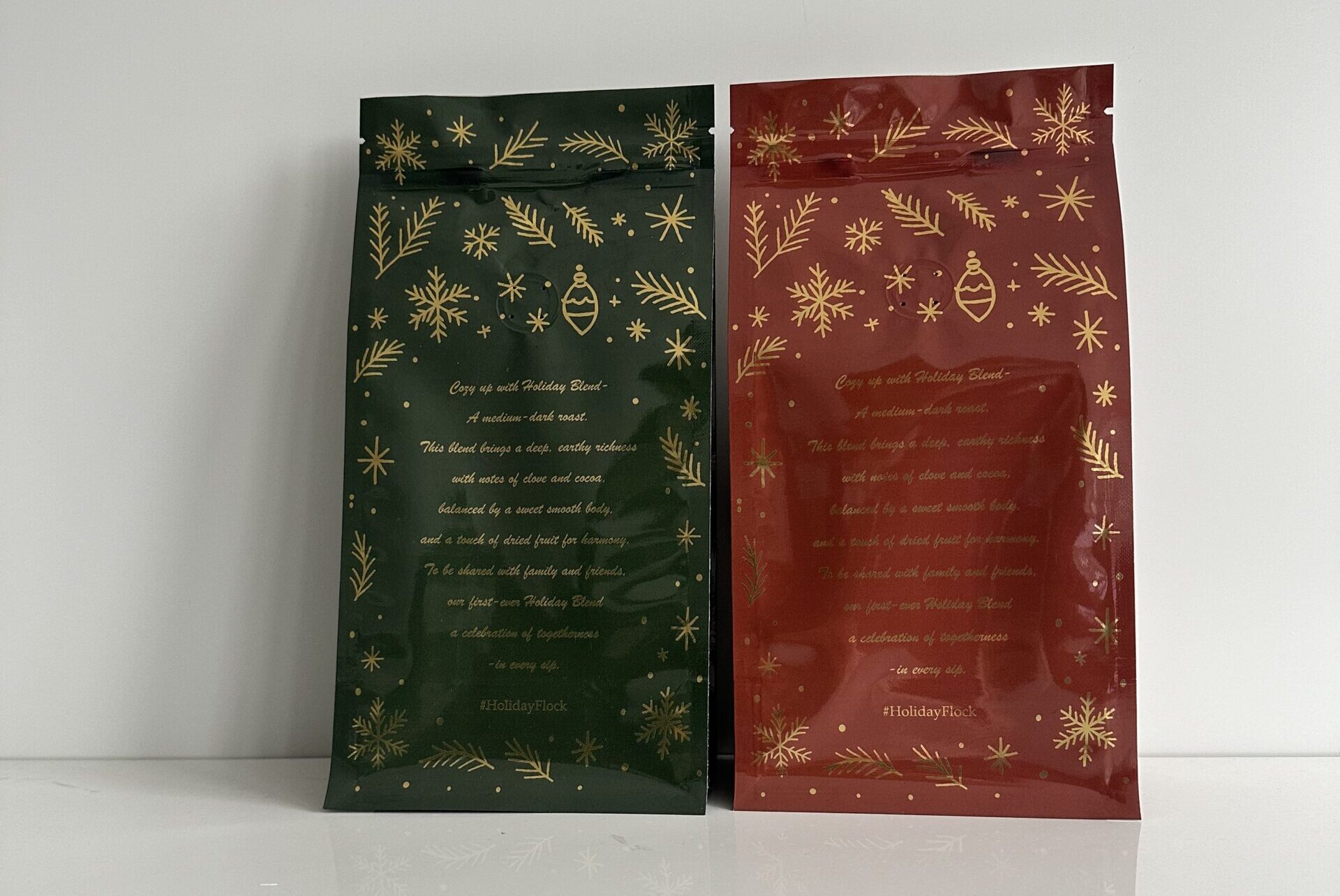

The Challenge Parakeet Cafe was preparing a holiday coffee blend promotion and needed custom digital printed pouches that reflected a festive, premium look. While the

Premium packaging sells — until it doesn’t. In an environment where raw material costs, shipping rates, and consumer budgets all fluctuate, the smartest brands are

Dimensional (DIM) weight pricing has become a major driver of shipping costs in e-commerce and industrial supply chains. Carriers charge based on the greater of